Contents

- Introduction

- Configuring QBO Company

- Enabling The Integration

- Syncing Data

- FAQ

- Common Issues and Fixes

Introduction

The QuickBooks (QBO) integration provides a way to sync your sales and inventory transactions to your QuickBooks Online account.

It makes one sales invoice per branch per day. Invoices will have associated payments based on your payment methods.

For inventory, a bill or a journal entry is created depending on the inventory transaction type.

This guide helps you to setup and run the integration with QuickBooks

Important Notes:

- This integration works with the global version of Quickbooks only, it doesn't work with US version, so make sure you are using the correct version of Quickbooks before using the integration

- QuickBooks Plus plan is required for the integration.

- Ensure all cashiers end day before uploading to QuickBooks

Configuring QBO Company

The integration requires you to do mapping between Foodics and QBO for certain entities.

This can be done by creating resources in QBO then link them to Foodics QBO Integration in the integration settings page

We recommend that you first create all needed resources in QBO before enabling the integration and starting doing the mapping

Follow bellow points for detailed explanation on each mapping section

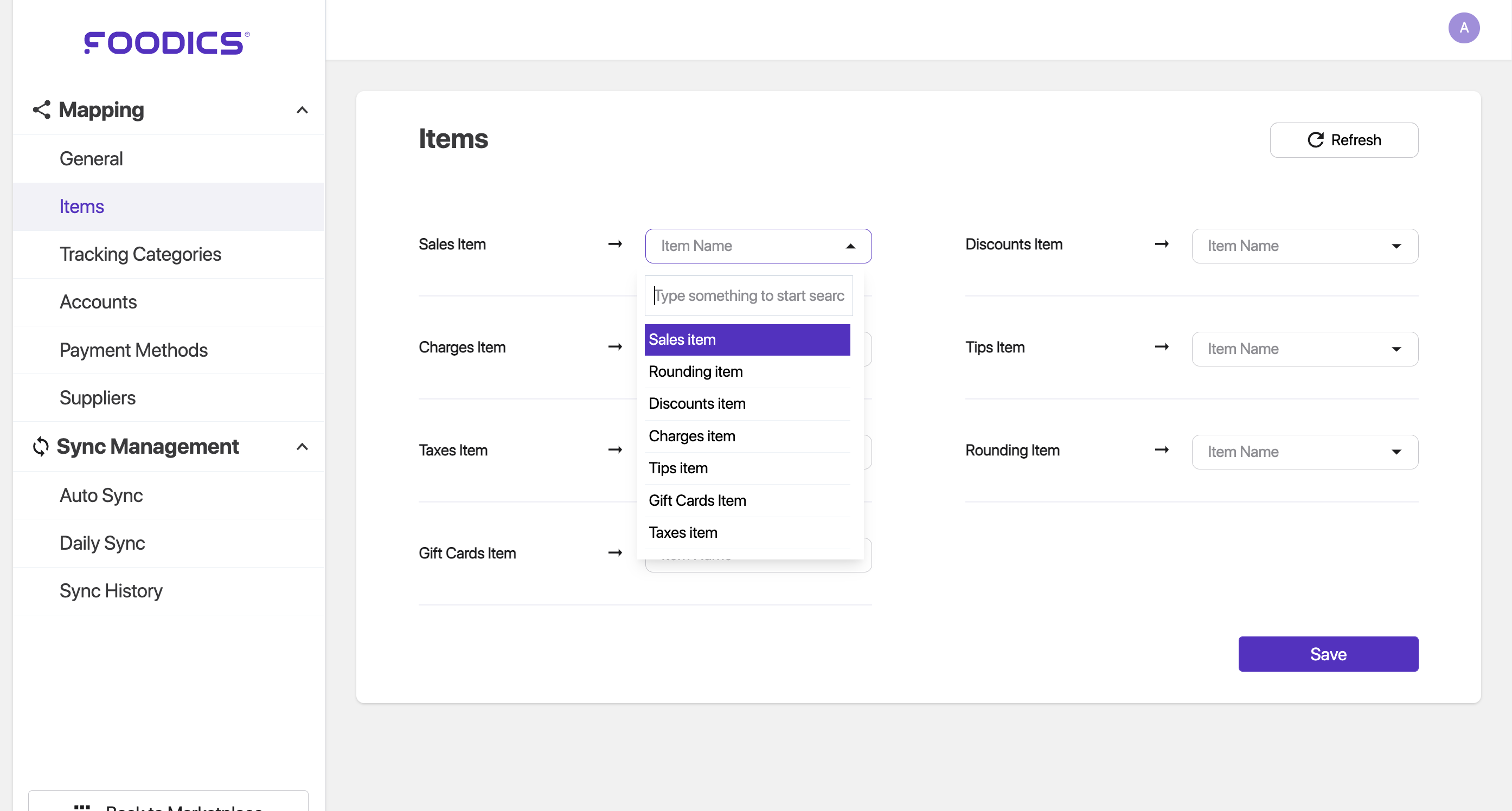

Items

When you sync sales from Foodics to QBO, the sync creates an invoice in QBO. The invoice contains Items

You need to map these items in order for the integration to know where to send the sales data

The invoice items are:

- Sales Item: holds the total amount of net sales

- Charges Item: holds the total amount of charges

- Tips Item: holds the total sum of tips

- Rounding Item: holds the total amount of rounding

- Discounts Item: holds the total amount of discounts

- Gift Cards Item: holds the net amount of sold and used gift cards

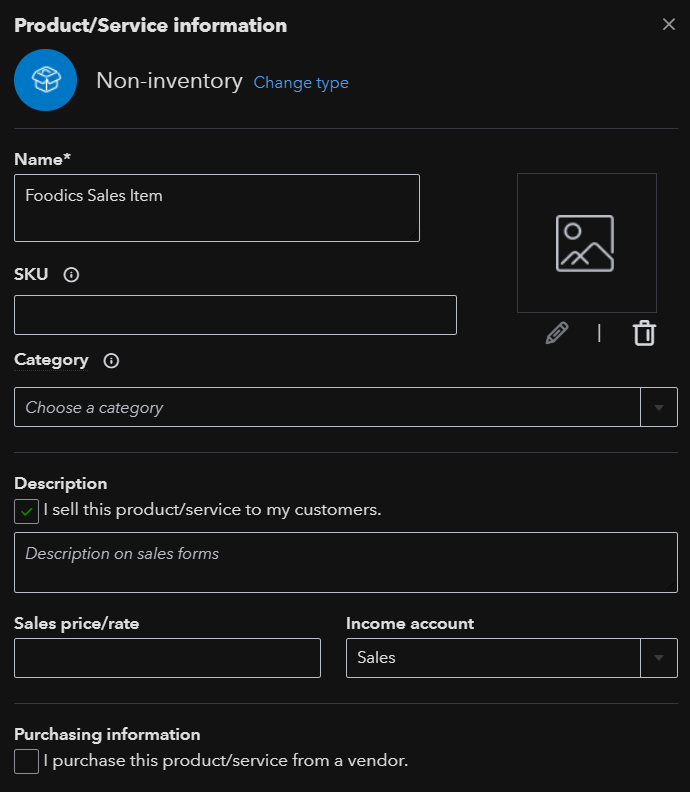

Creating The Items in QBO

1- Log in to QBO dashboard

2- From the lift side menu, Go to Sales --> Products and services --> Click New

3- Select Non-inventory, if you select another type, the integration will not work

4- Fill the Name field. Check the box I sell this product/service to my customers., and make sure to select an Income account

5- Don't choose a category, don't insert a selling price, and don't check the I purchase this product/service from a vendor box

Below is a sample of how you should add the items in QBO

Click to Zoom

6- Click Save and close

Do the same for each item in the integration settings

Note: If you didn't select an Income account for the item in QBO, the integration will not be able to create invoices

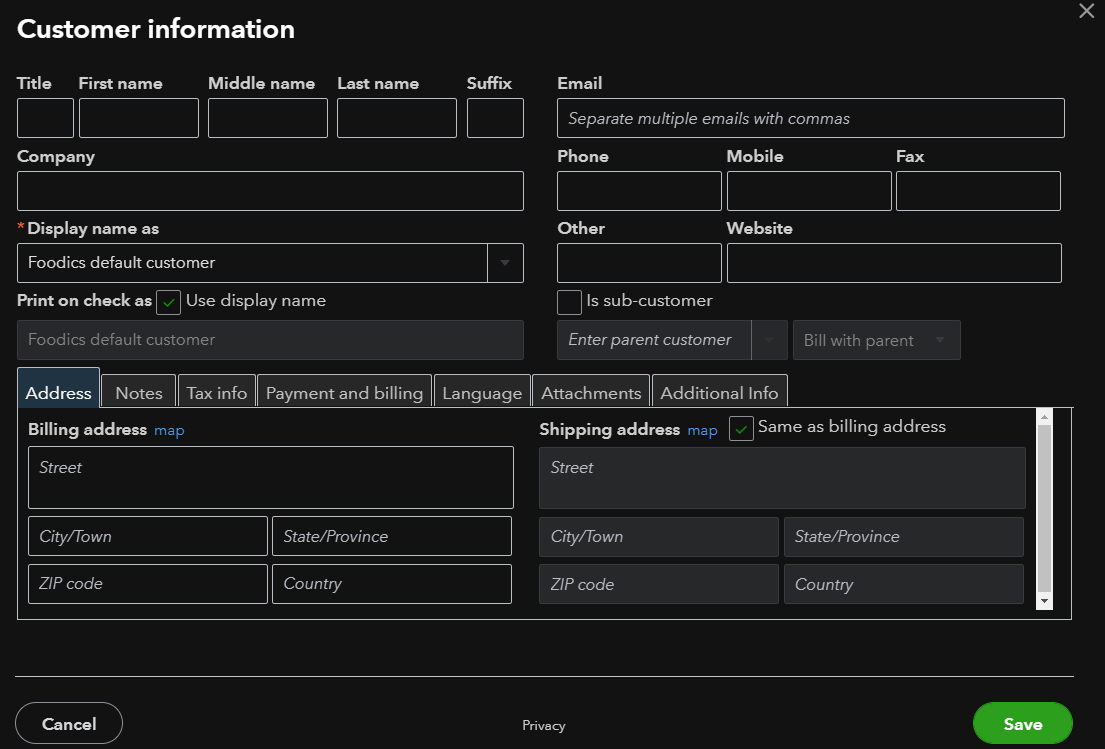

Default Customer

It is a requirement of QBO that each invoice must have an assigned contact. You should create a default contact to be assigned in the invoices generated by the integration

Creating Contact in QBO

1- From QBO dashboard --> From the lift side menu --> Sales --> Customers

2- If you have no customers in QBO, click Add customer manually. If you have customers in QBO, click New customer

3- Fill the field Display name as, other fields are not required. Below is a sample

Click to Zoom

4- Save

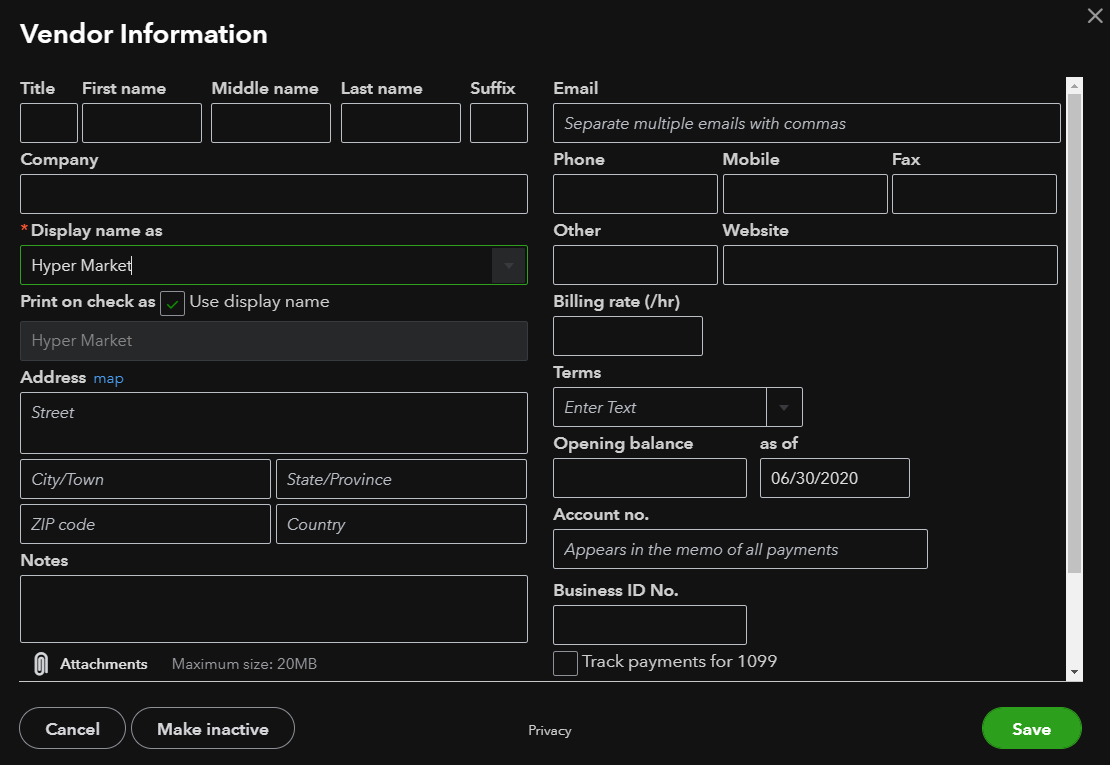

Suppliers

Suppliers are vendors used for bills in QBO. You should create one vendor in QBO for each supplier in your Foodics account. These suppliers are used when mapping purchasing transactions to bills.

To create vendors for Foodics suppliers, please follow the below steps

Creating Vendor in QBO

1- From QBO dashboard --> From the lift side menu --> Expenses --> Vendors

2- Click New vendor

3- Fill the field Display name as, other fields are not required. Below is a sample

Click to Zoom

4- Save

Do the same for each supplier in the integration settings

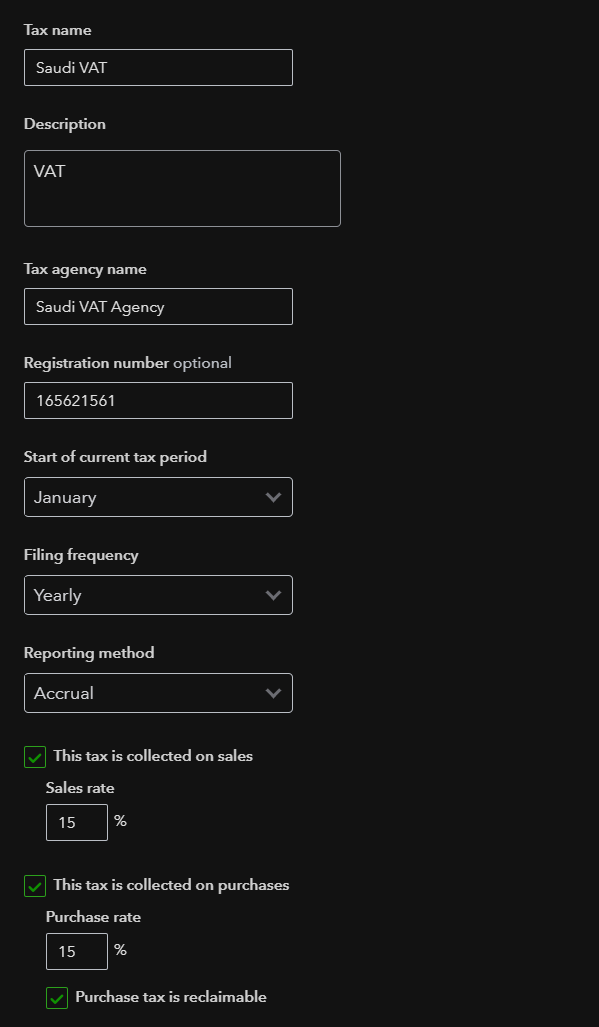

Taxes

The integration requires that you create a tax code that has one sales tax rate and one purchasing rate.

Note:

When the integration sends invoices/bills to QuickBooks, the integration sends that tax amount as is from Foodics. The tax amount is not recalculated in QuickBooks. This ensure the taxes amount is matching between Foodics and QuickBooks

To create Tax in QBO, please follow the below steps

1- From QBO dashboard --> From the lift side menu --> Taxes

2- If you have no previous taxes in QBO, click Set up tax. If you have previous taxes in QBO, click Add tax

3- Fill the details in the page and select the two checkboxes at the bottom: This tax is collected on sales and This tax is collected on purchases. Enter appropriate rates for the two fields.

Note: Check with your accountant if you should enable the option Purchase tax is reclaimable

Below is a sample

Click to Zoom

Note: The information in the above image is just for illustration. Make sure to check with your accountant for correct information

4- Click Next or Save

5- Click OK if available

Locations

Locations is how QuickBooks separates entries by branch. You should create a location for each of your branches and warehouses. Later you can generate reports by location.

You need to enable location tracking then you can add locations. Follow below steps

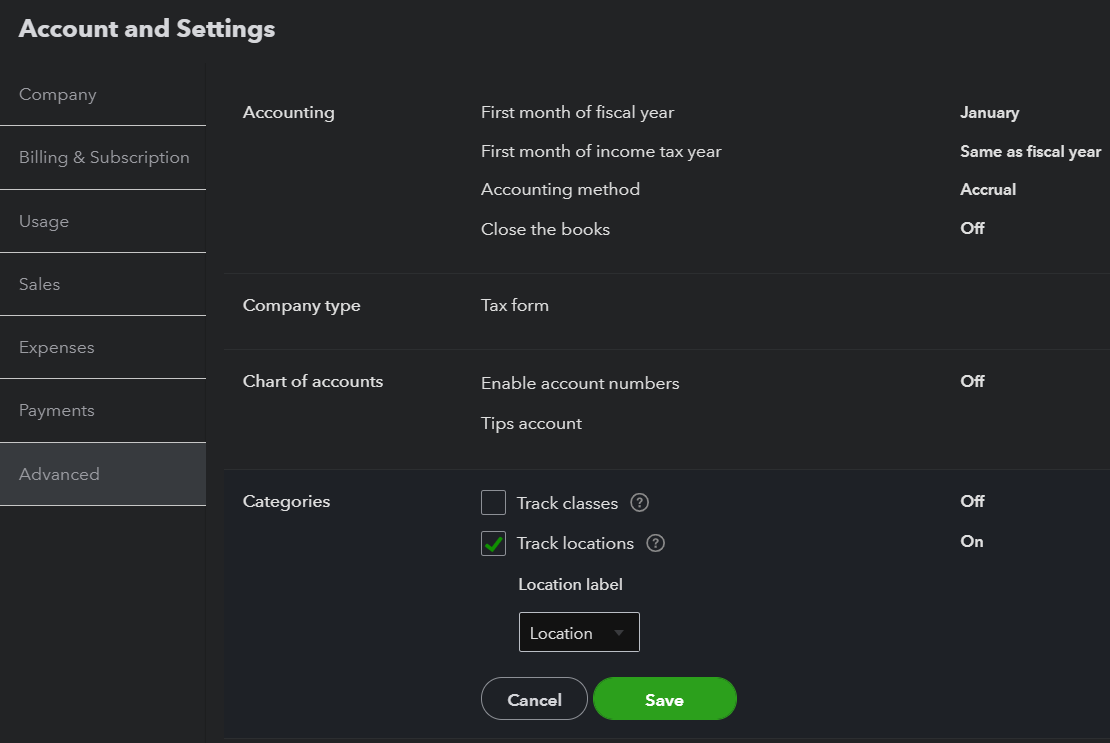

Enabling Location Tracking

1- From QBO dashboard --> Click the Gear Icon ⚙ on the top right --> Account and settings --> Advanced

2- Click on Track locations

3- Enable Track locations, as shown below

Click to Zoom

4- Save

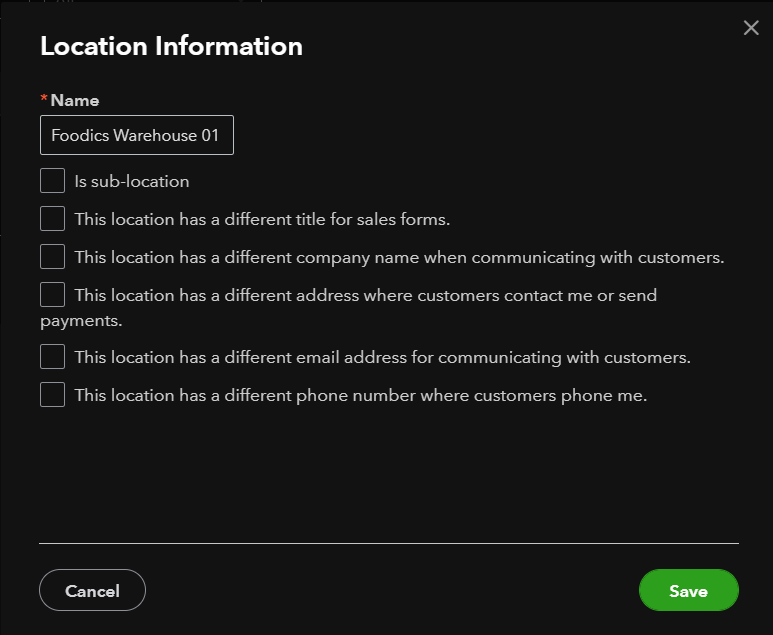

Adding Locations

1- From QBO dashboard --> Click the Gear Icon ⚙ on the top right --> All lists

2- Click on Locations

3- Click New

4- Enter a Name for the location, leave other options. Below is a sample

Click to Zoom

5- Save

Do the same for each branch and warehouse you have in your Foodics account.

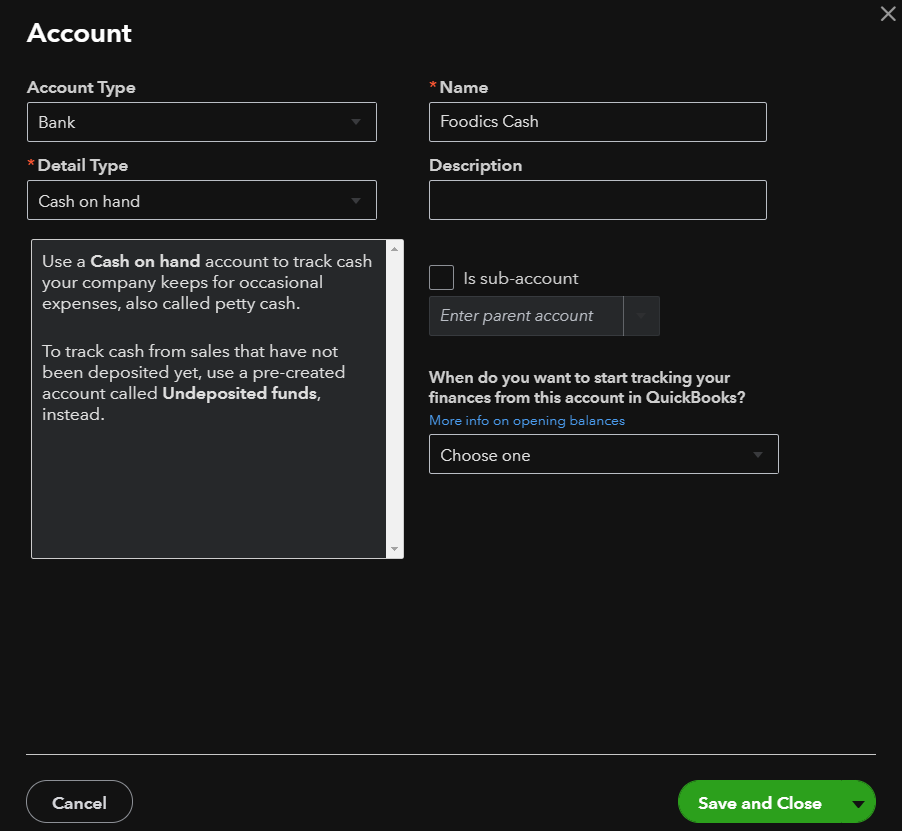

Payment Accounts

You should create one account in QBO for each payment method defined in your Foodics account. The payment accounts should either be Other current asset or Bank

These are the account that the payments will be deposited to

Creating Payment Accounts in QBO

1- From QBO dashboard --> Accounting --> Chart of accounts

2- Click New

3- Select an Account Type and Detail Type, add a Name to it, as illustrated in below image

Click to Zoom

4- Click Save and Close

Do the same for each payment method in your Foodics account

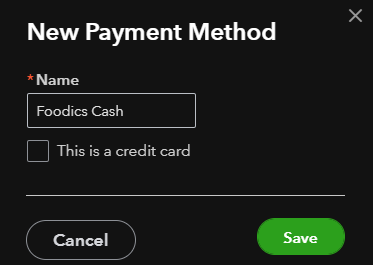

Payment Methods

You should create one payment method in QBO for each payment method defined in your Foodics account

Creating Payment Methods in QBO

1- From QBO dashboard --> Click the Gear Icon ⚙ on the top right --> All lists

2- Click Payment Methods

3- Click New

4- Enter a Name

5- Click Save and Close

Do the same for each payment method in your Foodics account

Inventory Accounts

These accounts are used for bills and journal entries as described in the Inventory Entries section.

The inventory accounts are as below:

- Inventory: Stores the cost of all inventory items

- Cost of goods sold: Stores the cost of consumed inventory items

- Inventory adjustment: Stores the cost of lost/damaged/wasted inventory items

- Pending transfers: Stores the cost of inventory items that are pending receiving. When you transfer items from branch A to branch B, items that are not yet received by branch B will be stored in this account

Creating Inventory Accounts in QBO

1- From QBO dashboard --> Accounting --> Chart of accounts

2- Click Add Account

3- Select an Account Type and Detail Type, add a Name to it, the same way you did in payments accounts

4- Save

Do this for the four inventory accounts mentioned above

Inventory Entries

Cost Adjustment:

If new cost is higher than old cost:

- Credit: inventory adjustment account

- Debit: Inventory account

If new cost is lower than old cost:

- Credit: Inventory account

- Debit: inventory adjustment account

Inventory Count

If variance quantity is positive (new item quantity is higher than original item quantity):

- Credit: inventory adjustment account

- Debit: Inventory account

If variance quantity is negative (new item quantity is lower than original item quantity):

- Credit: Inventory account

- Debit: inventory adjustment account

Quantity Adjustment

- Credit: Inventory account

- Debit: inventory adjustment account

Consumption from Orders Transactions:

- Credit: Inventory account

- Debit: Cost of goods sold account

Transfer Out:

- Credit: Inventory account

- Debit: Pending transfer account

Transfer In:

- Credit: Pending transfer account

- Tracking option: sender branch

- Amount: all sent cost

- Debit: Inventory account

- Tracking option: receiver branch

- Amount: received cost

- Debit: Inventory adjustment account

- Tracking option: receiver branch

- Amount: variance (lost) cost

Waste from Orders

- Credit: Inventory account

- Debit: Inventory adjustment account

Waste from Production

- Credit: Inventory account

- Debit: Inventory adjustment account

Return from Orders:

- Credit: Cost of goods sold account

- Debit: Inventory account

Enabling The Integration

Please ensure you have configured your QBO company as shown Here before enabling the integration

Follow below steps to enable the integration

1- Sign in to your Foodics account at console.foodics.com/login

2- Navigate to Marketplace page --> Search for QuickBooks under Accounting --> Click Install

3- Foodics will ask for your permission

Click Authorize App To Access My Account to proceed

Click Cancel Authorization if you want to cancel the process

4- After clicking Authorize App To Access My Account, you will be taken to QBO to connect to your QBO company

5- Sign in to QBO if not already signed in, select QBO company that you want to connect to (in case you have more than one QBO company)

6- Click Next --> Click Connect

7- You will be taken to the integration settings page as shown below, where you can configure and use the integration

Click to Zoom

Doing the Mapping

After creating all the needed resources in QBO as explained above, go to the integration settings page

1- For each section, e.g. Items, click Edit on the top right of the section

2- For each object in the section, click on the box against it

3- Select the appropriate resource from QBO, e.g. Foodics Sales item will be linked to the Sales item you created in QBO

4- Do this for all objects, DON'T leave any object with no mapping (empty box)

5- Click Save

Note:

- If you kept an object with no mapping (empty box), the integration will not be able to send data.

- If you would like to only synchronise your sales from Foodics to Quickbooks you dont have to map any inventory related feilds (inventory accounts, warehouses & suppliers).

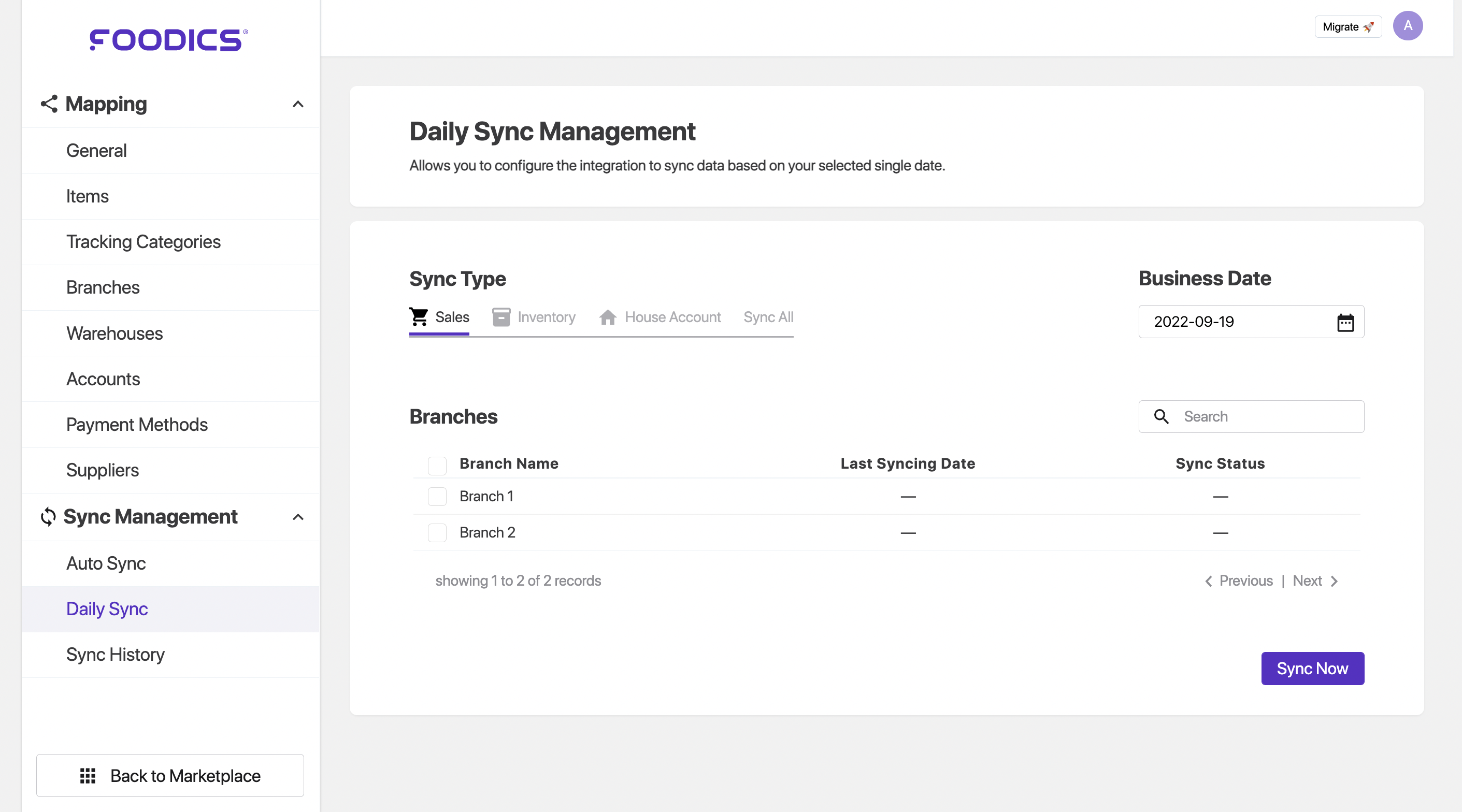

Syncing Data

After doing all the needed mapping, you can now sync data with QBO

The sync section is available in the integration settings page. You can access the integration settings through This Page, you can add it in your browser favorite bar for easier and quicker access

The sync is divided into there sections, Sales Sync, Inventory Sync, and House Account Sync

Notes on Sync:

- The sync can be done for a single business date at a time, you

can'tselect a date range - You can select to sync all branches at once, or sync specific branches

- House account sync is done for all branches by default

The sync section is available at the bottom of the settings page as shown below

Click to Zoom

Sales Sync

The Sales Sync will create an invoice in QBO for each branch in Foodics, so if you have three branches in Foodics and all have sales on the selected business day, the integration will send three invoices to QBO

The invoices are sent with payments and the payments are directly deposited to their mapped accounts, no manual action is needed in QBO dashboard.

Inventory Sync

When syncing inventory, the integration creates

- A bill for each Purchasing transaction made in Foodics. The bill will contain the supplier in QBO that is mapped to the supplier in Foodics

- A supplier credit note for each Return to Supplier transaction

- Manual Journals for all other inventory transactions

Note on Manual Journal: manual journals are sent to QBO in Draft status, you will need to log in to QBO and Post them manually in order for these manual journals to reflect on your accounts. This is done to give you a chance to review the entries before posting them

House Account Sync

Note: you can skip this sync if you don't use House Account in your business

When syncing house account, if there is a payment against house account for the selected day, the integration sends manual journals to QBO as below

- Credit: House Account payment account

- Debit: The used payment method account

Sample

A customer owes you 150 SAR on his house account, the customer came and paid 100 in Cash and 50 in credit card, the integration will send a manual journal with the following

- Credit: House Account payment account for 150 SAR

- Debit: Cash payment method account for 100 SAR

- Debit: Credit card payment method account for 50 SAR

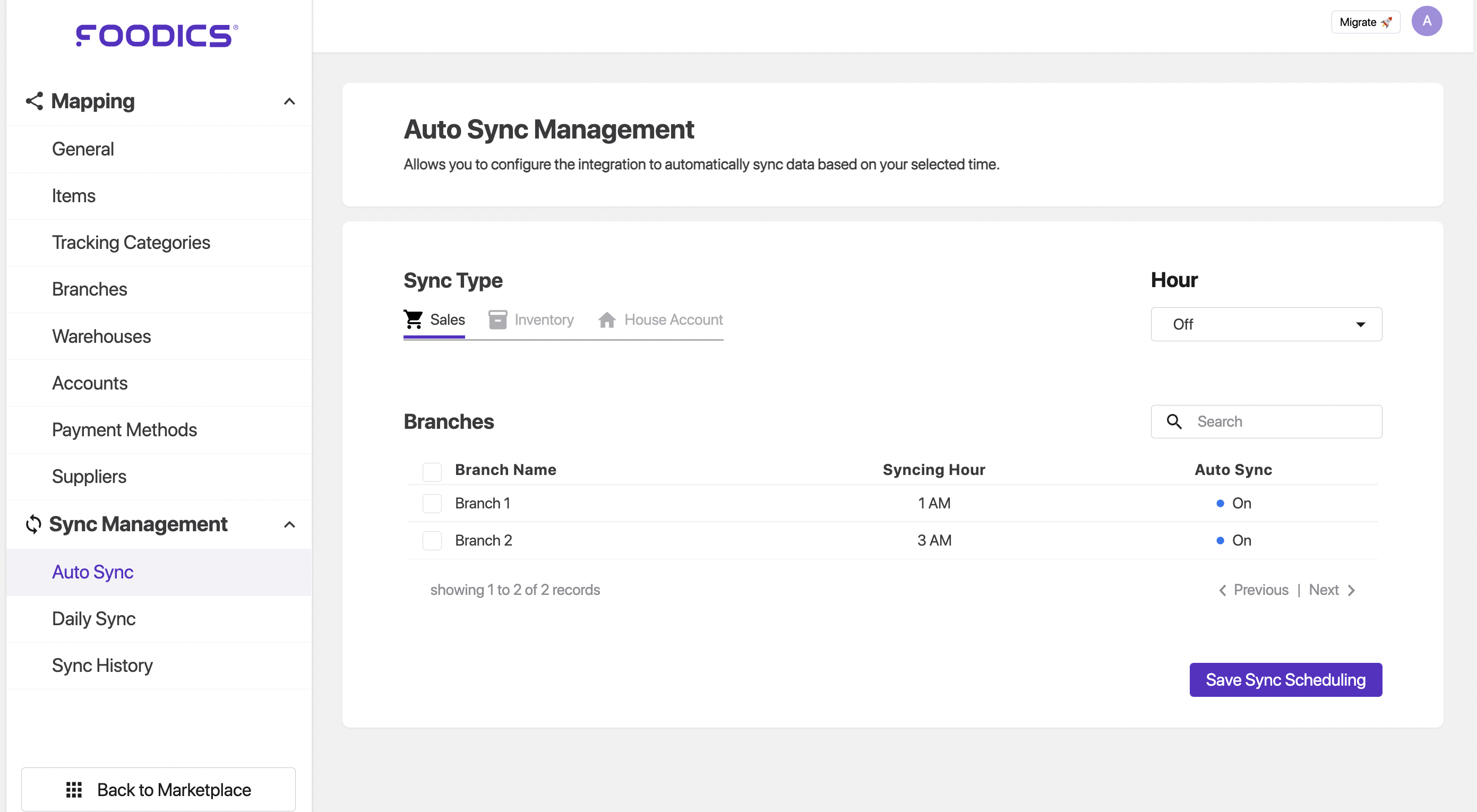

Auto Sync

Allows you to configure the integration to automatically sync data based on your selected time.

To setup the auto sync follow the below steps:

- go to the integration page

- navigate to auto sync

- select the

Sync Typeand select the branches - on the top right set the hour that you want to sync the at

- click save.

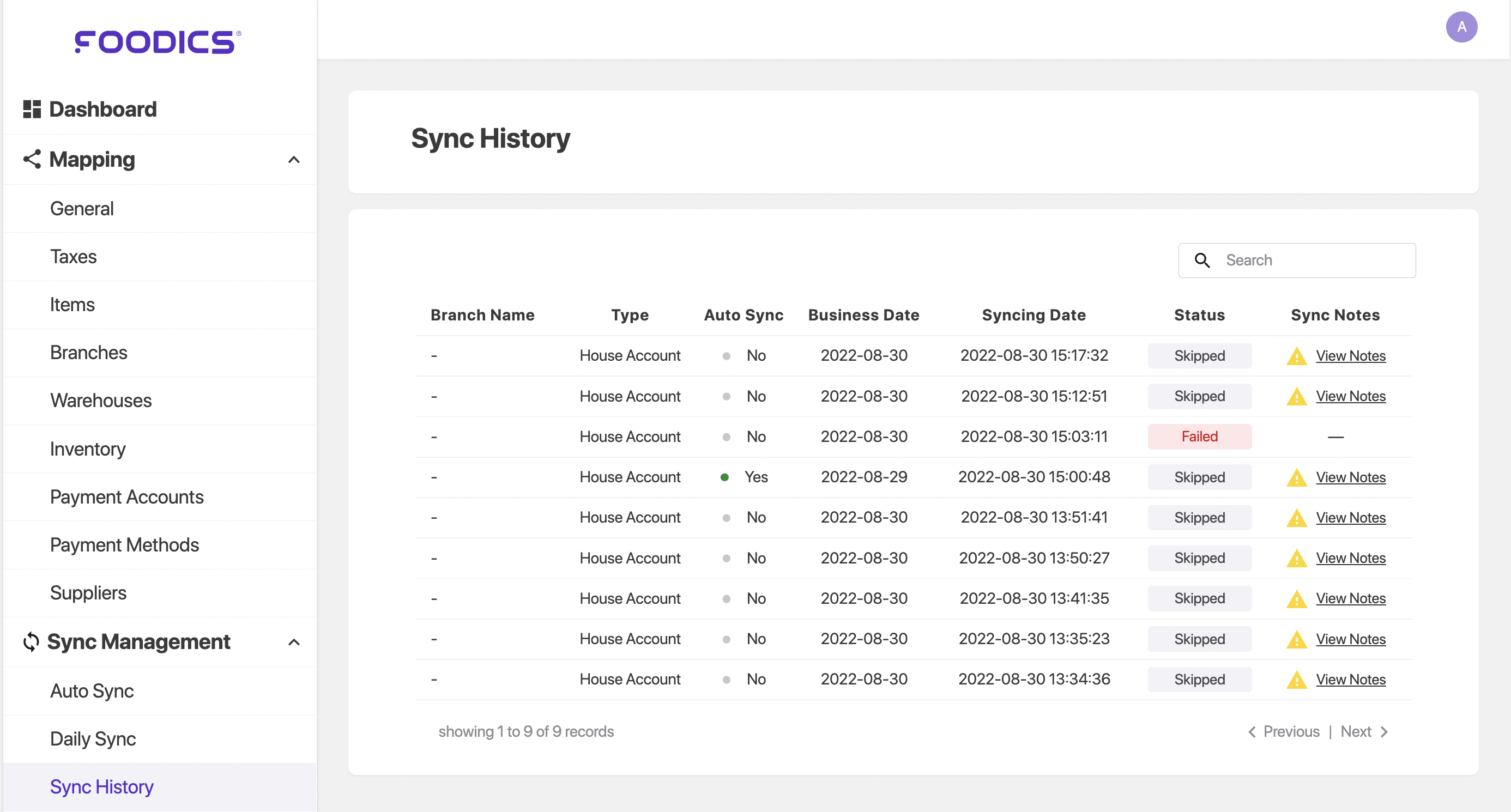

Sync history

Allows you to see the previous syncs that you did, their time, type, status, and the synced branch.

FAQ

Q1: I don't have a QuickBooks Account, how to sign up?

You can subscribe to QuickBooks Global version through https://quickbooks.intuit.com/global

Make sure to select the Plus version with correct country

Q2: I added new entities in QuickBooks but they don't appear in QuickBooks integration settings page, what should I do?

- Click

Refreshbutton on the entities you need to fetch the data for - Now recheck for the newly added entities.

or

- Check in Quickbooks if the wanted entities are

Active

Now recheck for the newly added entities

Q3: I was using QuickBooks integration on Foodics V3, do I need to redo the integration on Foodics F5?

You don't need to redo the integration in terms of creating accounts all over again in QuickBooks. You just need to do the mapping in the integration settings for the first time. Just like when you configured the integration for the first time on Foodics V3.

QuickBooks integration on Foodics F5 has introduced

- New sales item (Gift Cards)

- New sync section (House Account)

The guide explains how to configure each of these new additions

QuickBooks integration on Foodics F5 has removed

- Default Vendor

You no longer need to map Default Vendor on F5

Q3: What Timezone do the auto sync follow

It follow your foodics business account timezone.

Q4: can I do my syncs retrospectively?

yes, you can, by using the daily sync feature.

Q5: what should I do if a sync job fails?

before contacting support you need to check if you are facing one of the [Common issues and fixes link]

Q5: My country does not have taxes or apply zero taxes to sales, what should I do?

in this case create Tax in QBO, please follow the below steps:

1- From QBO dashboard --> From the lift side menu --> Taxes

2- If you have no previous taxes in QBO, click Set up tax. If you have previous taxes in QBO, click Add tax

3- Fill the details in the page and select the two checkboxes at the bottom: This tax is collected on sales and This tax is collected on purchases. Enter appropriate rates for the two fields.

4- Set the tax to 0.

in this way the integration will work and the taxes will remain exempt

Common issues and fixes

case 1: Sync Job keep failing (in the sync history)

in this case you need to check if all your fields are mapped, if all the fields are mapped check the below case.

case 2: the integration page does not fetch my Quickbooks data at all

- on the selected entity hit the refresh button

- if it didn’t work, go to your profile Icon

- click it and hit

logout - click connect

- on the top right hit the reload button

- reconnect again and the issue should be fixed